Markets rallied last week between 3 of the 4 astrological aspects reviewed in last weekend's edition.

It started with Venus in opposition to Saturn and continued into the lunar eclipse Full Moon (with the Moon conjunct Saturn) and tended to stall going into this weekend's Sun opposition Saturn aspect.

The remaining one of the four, and perhaps the most important, arrives midway through the coming week - Mars opposed to Saturn.

If markets continue rising into the aspect - and that is certainly possible given it's the end of the month - we will all need to watch target levels and oscillators very carefully for signs of a potential intermediate peak.

There are still no major alarm bells going off in the SP500's monthly charts, but signs of weakening are starting to become obvious in weekly charts.

However, since it has been a while since I reviewed the state of the Asian indices and because I neglected to update Canadian readers recently when I published updated Weekly Planets charts for Western indices, most of this edition will deal with those markets.

We'll also take another look at gold. I had an email exchange with an Indian businessman during the week who is tipping significant reversals in gold prices on May 10 and 17, based on his interpretation of the Vedic aspects.

I am by no means any sort of an expert on Vedic astrology, which forms part of the daily culture of Hindi society. However, I do know from past studies that it tends to be much better than Western astrology at predicting actual events and timing. As always, the accuracy of the forecast depends on both the skill and the bias of the interpreter.

The bounceback in greenback gold prices has been strong - and continues to conform to the planetary charts I revealed this year in Forecast 2013.

|

| click to view larger image |

|

| click to view larger image |

Obviously, the red FiboRx levels deal with only the recent nosedive, while the blue levels show a wider range from an earlier peak. What is interesting, at least at a surface level, is the apparent importance of 50% markers - something the ASX200 does often. Last week's continued bounce went close to recapturing the 618 FiboRx of the sharp downleg, before ending the week near the 50% marker.

Now that we have a wider range to view, we can see that the sideways shuffle before the plunge also took place within what can now be defined as a 618-50% horizontal zone. Important consolidations, either up or down, often become a 50% range marker. It could mean the gold correction is over. I'm still quite uncertain that is the case - and I wouldn't be confident about the resumption of a gold bull market until I see a marginally lower price trough accompanied by a higher low in the long-range oscillator.

Before turning to Canada and Asia, let's take another quick look at a chart I published recently for Pollyanna, the SP500.

|

| click to view larger image |

Now, my apologies to Canada. I forgot to update you when I last looked at the Western indices. So, to make it up, I'll give you both a Weekly Planets chart and a long-range version, starting with the latter.

|

| click to view larger image |

|

| click to view larger image |

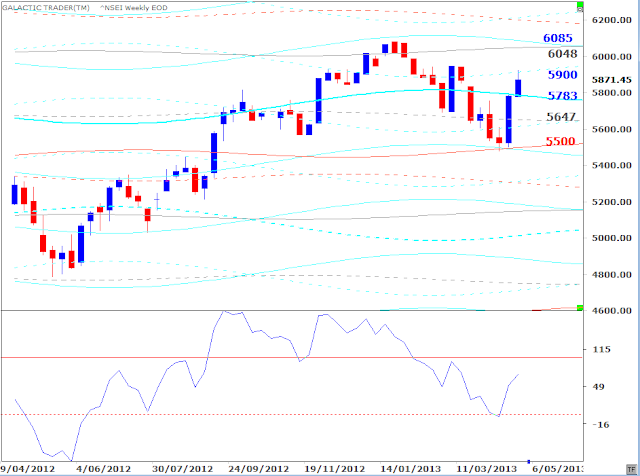

India's Nifty50 is next. It put in a recent bottom at a Saturn/Uranus level - and backed off last week from a weekly Saturn line. If the index is going higher, it could have the next Saturn/Uranus zone as a target - around the 6200s.

|

| click to view larger image |

|

| click to view larger image |

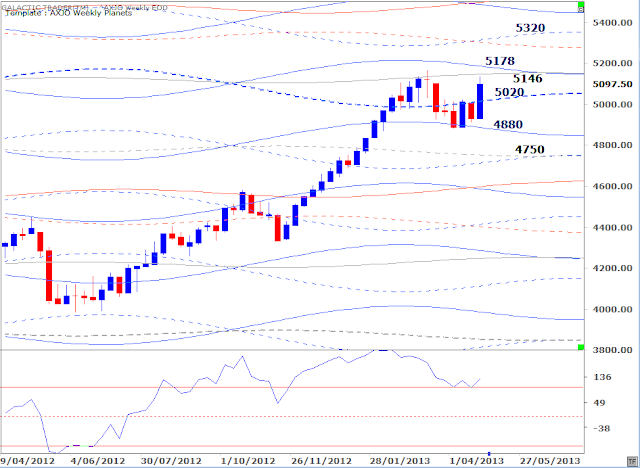

If you look at the chart, you can see the past importance of the grey Neptune lines. Having consolidated on top of the last one now priced at 4750ish, the higher level does seem to be a valid target.

|

| click to view larger image |

|

| click to view larger image |

|

| click to view larger image |

|

| click to view larger image |

|

| click to view larger image |

Safe trading - RA

Astrological Investing's associate, Randall Ashbourne, author of the eBook, The Idiot and The Moon, and The Idiot and the Moon, Forecast 2013, writes a free weekly column titled, The Eye of Ra on his web site in which he explains the potential impact of astrological aspects and the current state of technical conditions. Ashbourne's charts are revealing illustrations of exactly what has occurred in the market and the probability of what to expect.

Important reading: Randall Ashbourne's The Idiot and The Moon, Forecast 2013 , Jupiter's cycle and its effects on Wall Street and a posting of the weekly Eye of Ra report in this blog, titled A look at the Venus Retrograde effect

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

Copyright: Randall Ashbourne - 2011-2013

The Idiot and the Moon, Forecast 2013

The Idiot and the Moon, Forecast 2013Major trend change dates for the full year, plus a month-by-month breakdown of high-energy trading dates and critical reversal dates.

An index-by-index analysis of Moon Trading across major American, European, Asian and Australian stock indices-

Identifies the major indices where following the phases of the Moon can dramatically cut profits, or even result in large losses.

Old Gods & Gold ... a Eureka! discovery about exactly what drives gold prices during rallies and corrections and charts showing highly-reliable target levels to both the upside and downside.

0 comments:

Post a Comment

Note: Only a member of this blog may post a comment.