Randall Ashbourne, an associate of

Astrological Investing, posts a weekly market report on his web site,

theidiotandthemoon.com The following is this weekend's Eye of RA report: Week beginning February 24, 2014

The head honcho of the Old Gods, Jupiter, makes the second exact square with Uranus in the next few days.

Jupiter rules growth, expansion, optimism and Uranus rules technology in general and the stock markets in particular.

Every major astrological aspect between these two almost invariably causes a significant turn in the direction of the markets.

We'll take a look at the history in a moment.

Other stuff is also happening this week. Late in the week, the little mischief-maker, Mercury, goes Direct again as the Sun trines Jupiter (adding extra power to the Jupiter-Uranus square).

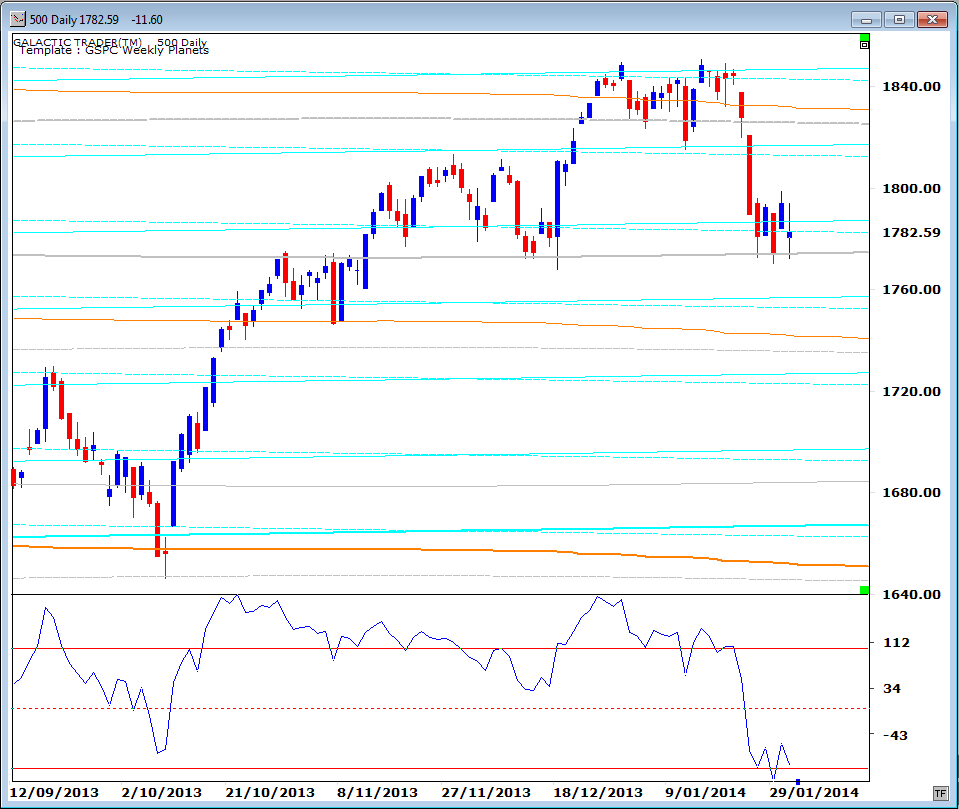

It's a weekly version of the Bi-BB charts we've been using for the past few weeks to track the potential for fast moves in short-term trends.

Let's begin, though, with an overview of the big astrological picture. We've chatted at length over the past couple of years about the long-running square between Uranus and Pluto and how these are always present when big, worldwide social shifts are underway.

I won't bore you - or me - by reiterating the symbolism now; other than to say that the "time" when we see actual events occur tends to arrive when that long-running square is triggered by a third planet making an aspect to Uranus or Pluto.

Enter the FatBoy. The chart below is a long-range monthly of Pollyanna, the SP500. Jupiter conjunctions to Uranus are marked with blue bars, trines with green bars, and the squares with red bars.

And all three tend to have a BIG impact. Jupiter

lurvs BIG. Study the chart for a few minutes. It's almost uncanny just how often strong Jupiter-Uranus aspects show up as Pollyanna is peaking into long-range tops ... 1968, 1973, 1983, 1987, 2000, 2007. And 2014??

Okay, that's enough of

The Spooky Stuff for this week. My Virgo Moon, Miss Prissy, will throw a hissy-fit if I don't pack away the crystal ball and start showing some

technical stuff. "Do try to be

practical, dear!"

So, anyway. For the past few weekends, we've been exploring how to use some lessons from

The Technical Section of the book to work out how we should trade some Bi-BB signatures when they make an obvious appearance in the charts.

It's all in the

Archives. Firstly, let's review last edition's warning about how gold was probably about to take a breather because it had broken the upside band. And ... lo and behold ... that's exactly what we got, at least for a couple of days.

In the longer-term, gold looks to have a lot more rally to come. For the moment, though, I'm just using this as another example of how to apply techniques from

The Technical Section to real markets in real time.

Because, while we saw how we could apply these trading rules to both Pollyanna and gold in the daily charts, we are starting to see a similar situation develop now in Pollyanna's weekly Bi-BB chart.

Notice how the bands are starting to pinch together. And remember the first rule ... a rapid tightening of the BBs is a warning that a fast move is approaching. In this case, because it's a weekly chart, the move will probably be of intermediate length, rather than short-term.

I also indicated last weekend that if the rally continued, rather than changing direction at the midpoint of the Mercury Rx phase, the maximum price Pollyanna would hit would be the 1860s.

Since we're in the statistically-positive period between 3Q and New Moon ... and with the Sun due to trine Jupiter ... 1864 remains a valid target for the coming week.

But first, it would have to overcome a Weekly Planets barrier - a double Saturn zone which stopped the two previous attempts to break northwards.

And our Big Bird oscillator is, so far, distinctly unhappy with this testing of the previous Highs!

Also, we've been discussing how the SP500 is currently trapped between rising and falling primary planet lines belonging to the Sun, Mercury and Venus.

Mercury is the two sets of pink lines and Miss Polly played with the falling Mercury line all last week.

Now, let's swap hemispheres for a look at my home market, Australia. The ASX 200 closed the previous week with a break above a Weekly Planets Saturn barrier in the early 5330s ... and is trying to reach the next Saturn/Uranus zone between 5466 and 5504.

We have 3 Canaries in the oscillator panel - 6, 14 and 50 CCIs. The most important is the 50 - Big Bird - which is suggesting one of those prices should be hit.

The green oscillator is the 6 - Fast Bird; and the red is the 14 - Medium Bird. It is already rolling over, suggesting the end of this rally is now very close.

And there's a technical validation for that, too. Below is Auntie's long-range monthly showing Fibonacci Retracement levels; red for the Bull run from the early 2000s into the 2007 top and blue for the Bear collapse into 2009.

It's fairly obvious from even a quick look just how important one or the other of these FiboRx levels have been during the past 5 years.

Short story: Auntie is AT strong resistance and the long-range Big Bird is distinctly unhappy. Now, we have been waiting for EXACTLY this technical condition to start showing up ...

higher price Highs with a

lower Big Bird high! Negative divergence - on a long-range, monthly chart, warning that the Bull is getting ready to morph into a Bear.

We're not about to wave our arms around and call

Abracadabra! just yet. A breakout could rush Auntie up another 400 points (and perhaps worsen the Big Bird divergence in doing it).

But, but ... start putting these technical conditions together with the track record of the FatBoy making aspects with the Weirdo and we see why it's finally nearing time to be very, very cautious.

Safe trading - RA

Astrological Investing's associate, Randall Ashbourne, author of the eBook, The Idiot and The Moon, and The Idiot and the Moon, Forecast 2014, writes a free weekly column titled, The Eye of Ra

on his web site in which he explains the potential impact of

astrological aspects and the current state of technical conditions.

Ashbourne's charts are revealing illustrations of exactly what has

occurred in the market and the probability of what to expect.

Important reading: Randall Ashbourne's The Idiot and The Moon, Forecast 2014

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

Copyright: Randall Ashbourne - 2011-2014