Well, the snugglepuss session with Venus and Jupiter making kissy-smoochy in Leo is almost over.

Now the wicked warrior is heading for a confrontation with the old guy who eats children ... and Venus will throw a hissy fit with both of them.

As expected, stock markets had a nice lull in the developing storm last week as the Prince and the Showgirl headed into their leonine love-in and the general tendency for a price rise into the aspect held firm.

Now we need to think about whether such grand passion can last. Mars, in Scorpio clothing, is heading for a conjunction with Saturn. This won't be pretty. Think ... Cesare Borgia and the "charm" of a King Cobra off for a little chat with the King of Naples. Soon to be the dead, former King.

Venus will make a tense square aspect with both of them ... and the Sun leaves sunny Leo for picky Virgo, where he'll oppose Neptune.

Now, these key aspects pack enough power to turn the markets again. They're not happening this coming week, but the following one.

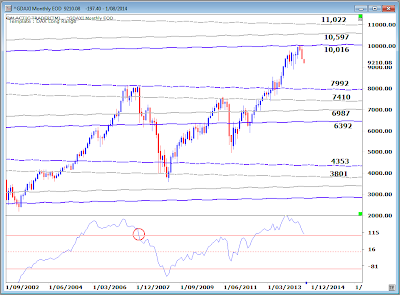

Last weekend, I published a chart showing the general tendency for stock prices to rise into the annual Venus-Jupiter conjunctions. Now let's take a look at the historical track record of Venus square Saturn, Mars conjunct Saturn and Sun opposed Neptune, marked below with blue, red and green bars respectively.

The other reasonably significant astrological event is that Mercury moves into Virgo this weekend. It's indicative of a mental shift, a change in thinking from grandiose speculation and bold statements to a much more measured outlook and demands for real, hard, actual evidence.

As in ... You can say you bombed a secret Russian convoy, but now it's time to show-and-tell, not just bluff, bluster and try to bravado your way through. And that's not just a matter for little Mercury. The Sun opposed Neptune may well see a "big lie" exposed for all to see.

Still, enough with all of that. Time for some techie stuff. And since it has served us none too shabbily for the past few weeks, let's return to the Dow Jones Industrials daily. I've gone back to the really basic. As expected, the Dow had a better week and managed to climb back above the orange horizontal.

But! The bounce was not enough to get the Dow back inside its longer-term rally channel. So far, it's only a retest of the rising channel's bottom line.

And ditto at a daily level for Pollyanna, the SP500.

Okay, now let's return to some specific planetary price levels. I said last weekend: "I'd have thought she (Pollyanna) should be able to climb above Mars in the coming week, and if she does, we need to watch how she handles the $1958 Node price line." If you recall, the falling Mars line was priced at 1940 for last week. Polly regained it and on Friday attempted to break through the 1958 level. And failed.

Let's hop across the Pond and consider the state of the FTSE. I've shown you the long-range planetary price chart for the German DAX a few times recently.

London made a retest of the 6526ish planetary price level during the August spike down and has bounced again.

What worries me about the bounce, though, is its weakness. I've marked the general area of this very long sideways shuffle with a couple of thin black horizontals, which also cover the previous Bull peaks.

But the Big Bird oscillator is getting very unhappy.

Okay, the ASX200, which enjoyed a stronger love-in bounceback than most other markets. As with the Dow and Pollyanna hitting either planetary price lines or technical trendline levels, the index now has to crash through ... or face the prospect of at least a mini-crash developing.

And gold. Spikes to the topside, spikes to the downside. A shiv into the Bears one day, a skewer into the Bulls the next. Personally, I remain long-range bullish and short-range totally relaxed. And bored by the games.

Safe trading - RA

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)Copyright: Randall Ashbourne - 2011-2014

Astrological Investing's associate, Randall Ashbourne, author of the eBook, The Idiot and The Moon, and The Idiot and the Moon, Forecast 2014, writes a free weekly column titled, The Eye of Ra on his web site in which he explains the potential impact of astrological aspects and the current state of technical conditions. Ashbourne's charts are revealing illustrations of exactly what has occurred in the market and the probability of what to expect.

Important reading: Randall Ashbourne's The Idiot and The Moon, Forecast 2014