Randall Ashbourne, an associate of

Astrological Investing, posts a weekly market report on his web site,

theidiotandthemoon.com The following is this weekend's Eye of RA report: Week beginning December 3, 2012

We'll

spend our time this weekend looking at the price targets likely to turn

major stock indices during the final month of the year.

It was an exercise we went through at the beginning of November and I think it was probably worthwhile.

Astrologically, there are only a couple of significant aspects over the next couple of weeks - beginning with a Sun opposition to Jupiter at the start of this week.

We'll take a look at the historical impact of that aspect - a once-a-year event - in a few moments. The only other major aspect is next week, when Uranus reverses and moves to Direct motion again.

For the remainder of the month, these weekly reports will be brief while I do some overhauling of the website and produce a Forecast 2013 report likely to be available in early January.

For the moment, a personal digression. Those of you with a working knowledge of astrology will understand when I say my November 2011 Solar Return chart had the Sun in the 4th house ... so, naturally, I've spent most of my energy in the past year building myself a new home.

This year's SR chart puts the Sun conjunct the Ascendant ... which indicates I'll concentrate in the coming year on putting more of myself "Out There".

As it happens, the shift of the Solar Return Sun into angular - action - houses, coincides with the end of a very l-o-n-g transit of Saturn through the first quadrant of my natal chart; what Grant Lewi called "the obscure sector" and which represents a timespan during which it can be difficult for an individual to make outward progress.

I won't dwell on this, since I know most of you have only a passing interest in the Spooky Stuff. In a nutshell, there are a couple of longish periods in life where one tends to withdraw from the outer world ... for rebuilding the base of the personality, personal finances, one's thought patterns and education ... and one's home base.

When it's over, one becomes revitalised and ready to venture forth again. So, over the course of the next year, I'll have more time and energy to devote to these pages and to start making changes. I hope you stick around!

Now, enough of the personal stuff ... let's get down to business.

The week kicks off with the Sun making at opposition from Sagittarius to Jupiter in its Detriment sign of Gemini. Sun in Sadge is usually the time of year when optimism reigns and we get the annual Santa Claus rally. This year, though, it begins with Jupiter in Gemini, the sign in which there's usually more talk than action.

Our first chart this week looks at the historical behaviour of Pollyanna, the SP500, following Sun-Jupiter oppositions.

|

| click to view larger image |

These aspects have a general tendency to occur nearby an intermediate trend change. Of the 12 previous aspects marked on the chart with red bars, 7 or 8 of them happened very near temporary tops, 3 of them very near temporary bottoms, and only a couple of them midway through a move.

In the last Bull run from 2002 to 2007, three of the four Sun-Jupiter oppositions marked out a temporary topping zone. That happened only once during the current Bull recovery.

However, we can see from an eyeball view that Sun-Jupiter aspects have a more reliable tendency to change market direction than the much-vaunted, but ultimately misleading, Mars-Uranus aspects. And that when there is a change, it tends to be in effect for several weeks.

Now, there's a chance this week's aspect will do not much of anything. However, since it's the only significant astrological aspect in play for the next couple of weeks, we need to consider that it's an historically strong aspect playing in an otherwise unaspected field.

So, we'll now go through the planetary price charts for a broad range of indices to get some idea of the probable upside and downside targets for the remainder of the year.

We'll begin with Miss Polly, Wall Street's broad-based 500 index.

|

| click to view larger image |

We went through this exercise at the beginning of November, a month affected by the gyrations of a Mercury Rx phase. Ultimately, though, the long-range planetary price lines contained most of the month's action and it would have been highly profitable to Enter and Exit positions at the 1410ish Neptune level and the 1358 Pluto line.

There seems to be two ways to play December. If 1412 holds and we get a Santa rally, the obvious targets are the previous Highs ... or a fast run into the 1500s.

If the Sun-Jupiter aspect represents a peak of optimism and a downturn develops, the downside targets are equally obvious.

Next, we'll look at the Nasdaq 100.

|

| click to view larger image |

What is significant with this chart is the degree of negative divergence in the fast MACD. I don't rule out the possibility of a new High. I think The Technical Section of The Idiot & The Moon points out that three instances of divergence are often necessary in the MACD before a major trend change in price actually takes place.

What is obvious above is that the last price high came with a lower peak in both the MACD signal lines and histogram ... and that the higher low was recorded with a deeper trough in the MACD signal. In brief, the internal momentum within the tech stocks is getting weaker.

Turning to Europe, we'll start with Germany's DAX, the strongest of the main indices.

|

| click to view larger image |

Prices on the DAX remain contained within the same planetary price zone which capped the 2011 Highs. Uranus lines are marked in orange and a close study of the history of the weekly bars makes their impact rather obvious. It would need a very decisive weekly close above 7500 to set up the DAX for a merry Christmas.

Next we go to London's FTSE.

It, too, has been rangebound for many weeks, broadly within the range which marked out the 2011 topping pattern. Again, the prices at which one could consider initiating or exiting a trade, in either direction, are obvious.

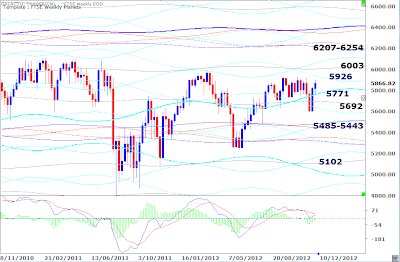

Moving to Mumbai ...

|

| click to view larger image |

India's Nifty 50 has been playing sideways shuffle in the 5600s for the past few months ... and the strong breakout northwards comes with a very indifferent attitude from the MACD.

Singapore is next ...

|

| click to view larger image |

Make note of the grey lines on the STI's chart - Neptune - and notice the clustering which took place at the 2010 tops and at both sets of 2012 sideways shuffles. It means the final target for any sustained rally is about 10% higher than last week's close ... with a stalling process likely in the early 3200s.

On the downside, the strongest Support doesn't come into play until the 2700s.

Honkers ...

|

| click to view larger image |

Obviously, the most important current line for the Hang Seng is the primary Saturn line, whose price is around the level of last week's Low. Again, the MACD signal is weakening, though not yet to the point where the signal lines have crossed to negative mode.

Shanghai ...

|

| click to view larger image |

The last time we looked at Shanghai, the index was trying to recover above the primary Saturn line (currently priced at 2170) ... and with some degree of positive divergence in the state of the long-range Canary. Nevertheless, the attempt to recover the ground has failed, though the potential turnaround divergence is still building in the oscillator.

And, finally, Auntie - the ASX200 ...

|

| click to view larger image |

The significance of the current orange Uranus price zone is obvious from past performance ... Support during 2009, 2010 and 2011, turning into Resistance during the recovery from the August/October plunge of 2011. If the old bat can decisively break above 4546, she has the potential to run to almost 4800. Decisive failure of the 4453 level, means the drop is unlikely to stop this time above 4200.

My apologies to Canadian readers. I'm still having trouble with TSX data. I know Google Finance has it; I'm just having a great deal of trouble converting it to a format the software likes! Playing with spreadsheet formulae is not, y'know, a Sagittarian strong point ... even if the Sadge in question does have a prissy and practical Virgo Moon!

Okay, that's a wrap. Please keep note of this weekend's edition, since I intend going into "lite" mode for the rest of the month so I can spend some time working on next year's Forecast and plans for an overhaul of some parts of the website.

Hopefully, the Forecast will be ready by the first week of January. I'll keep you briefed on the details late in the month.

Safe trading - RA

Astrological Investing's associate, Randall Ashbourne, author of the eBook, The Idiot and The Moon, writes a free weekly column titled, The Eye of Ra

on his web site in which he explains the potential impact of

astrological aspects and the current state of technical conditions.

Ashbourne's charts are revealing illustrations of exactly what has

occurred in the market and the probability of what to expect.

Important reading: Randall Ashbourne's article, Jupiter's cycle and its effects on Wall Street and a posting of the weekly Eye of Ra report in this blog, titled A look at the Venus Retrograde effect

(Disclaimer: This article is not advice or a recommendation to trade stocks; it is merely educational material.)

Copyright: Randall Ashbourne - 2011-2012